ASML Holding (ASML)

Hi!

If this company would be American it would be much more expensive. Today I present you the most important company in the semiconductor industry- ASML Holding. You may think about semiconductors as “pick and shovels”. In that way ASML is “pick and shovel of picks and shovels”. This post will be a combination of data and my personal view, so please remember that this is not an investment recommendation of any kind.

I am going in the following order:

Brief history

Market and Products

Financials

Stock/Valuation

Risks

Summary

Brief history

ASML was founded in 1984 as a joint venture between the Dutch companies Advanced Semiconductor Materials International (ASMI) and Philips. They have become independent four years later, changed the name for the current one (L stands for Litography) and since 1995 they are listed in Amsterdam and New York.

Market and Products

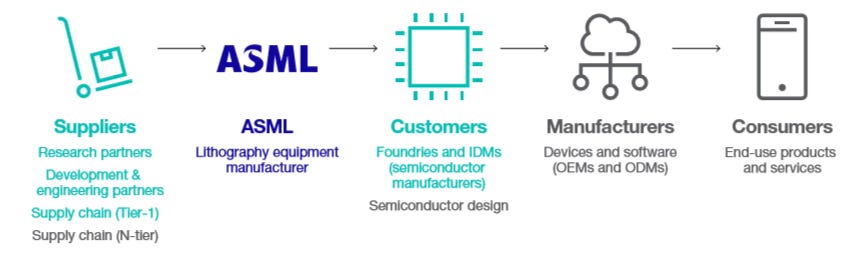

ASML is the world's largest supplier of lithography systems for the semiconductor industry. These extremely complex machines play a crucial role in the production of integrated circuits. Lithography is simply about using light in a very complex way to print very small patterns on silicon. This is truly a fundamental step in microchips mass production. And those chips are in all of the electronic devices, cars, phones and many more.

Worth to mention that Moore's Law is the main principle for the semiconductor industry, driving the transition from mobile computing to ubiquitous computing.

The main type of systems offered by ASML is EUV (Extreme Ultraviolet Lithography), which stands for 45% revenues in the last quarter (Q2’21). This is the most important one, because it is the newest technology and its role is systematically growing. As company wrote in the last company presentation:

EUV will enable continuation of Moore’s Law and will drive long term value for ASML well into this decade.

The global EUV lithography market is expected to grow at a CAGR of 12% till 2027.

The products are sold mostly to the Asia markets (the main customer is Taiwan Semiconductors, which producing for example M1 chips designed by Apple).

However, there would be no such devices without not only hardware, but also the appropriate software. And ASML provide it too, relying, for example, on technique called model-driven engineering (MDE) or machine learning tools, which helped speed up the manufacturing process dramatically over many years.

Basically 80% of all chip manufacturers in the world are ASML customers and their global market share has reached already 65% . They offer worldwide customer support at over 60 service points in 16 countries, hiring over 28,000 people.

ASML as the global leader in litography created a huge moat over all these years, because their products are extremely complex and difficult to recreate. The more so as the size of the semiconductors seems to be close to the minimum size, so further innovations will be extremely difficult to achieve without many years of experience.

Financials

After looking at the ASML business, let’s take a look at the financials:

ASML growth is not so high, but stable (about 20%), as same as EBITDA, Income and Free Cashflow as well (in 2021, as their CEO - Peter Wennink - said, they are expecting even 35% revenue growth). Moreover, their business model allows for achieving high margin levels - 32% EBITDA margin and 25% Net margin respectively (as 2020).

Debt level was quite stable during the last 5 years, just in last year there was some increase. Current liabilities are covered even by cash alone, so I am not worry about liqudity at all.

Definitely worth mentioning is FCF/Sales levels, which are consistently growing through years.

Company pays reliable growing dividend (around 1% yield) and conducts a share buyback program, but most of cash stays in the company, so I am not worried too much.

Stock/Valuation

Company valuation multiples are growing steady and it is not cheap company for European standards. However, as I marked in the beginning, it would be much more expensive if would be American. Just look at the Price off ATH chart. Company returned much faster than the market during the last year collapse. Since then, the bigger correction was just 17%, so the stock price seems to have really nice momentum phase.

Actually one thing about shareholders structure worries me a little - the whole board has only 0,02% of total shares. I would like them to be more “skin in the game”.

Risks

Actually I can see two risks, which I am a bit concerned.

First, the company is dependent on a limited number of suppliers in some areas. For example, Carl Zeiss is their sole supplier of lenses, mirrors, illuminators, collectors and other critical optical components.

And the second one, they derive most of revenues from the sale of a relatively small number of expensive products (258 units sold in 2020, 229 units in 2019), so any delays can have a big impact on financials.

Summary

ASML is very reliable with about 20% CAGR in revenue and over 40% in stock. Maybe it is not as exciting as some high growth names, but as backbone of semiconductor industry (which role in the global economy will be only higher) it is definitely great high quality business with promising future.

I am a proud shareholder and ASML is my biggest holding, because of their reliability and low deviation (both in business and stock price). Although, I am aware of the risks involved. I believe that company will deal with them nicely.

The company planned the Investor Day on 29 September 2021 in London and going to update their financial guidance for 2025. The last one, provided in 2018, stands at 15-24 bln EUR in revenue. But in 2020 the revenue was already 16 bln, so I guess there should be big increase in projections. Especially that they are expecting 35% growth in 2021 (it would be 21,5 bln EUR in 2021 already). So I am looking forward to this meeting and I am very curious about all the updates and eventually the company’s future.

———————

Please let me know what do you think, any feedback will be much appreciated :)

Great work here. Glad I found you, I look forward to more. I was looking at the entire semiconductor industry and when I started to understand what kind of a monopoly ASML is I got excited...but when you do a DCF analysis on them you will notice that majority of their market value is coming from cash flows generated after like 30 years...This means the market is saying that no other players will enter the market, compete hard enough. Throughout history big computer companies (IBM), Intel, have fallen behind. This for me is the biggest risk. You would be paying dearly (for a monopoly sure...) but it's still hard to bet that they will maintain such a monopoly in future in such a lucrative space