Adobe (ADBE)

Hi!

You probably associate it with PDF, some maybe with Photoshop. But did you know that Adobe is able to generate 40% net margin and entering into AR? Multiple moats, but also multiple competitors. Let’s check it out!

This post will be a combination of data and my personal view, so please remember that this is not an investment recommendation of any kind.

I am going in the following order:

Brief history

Business Model

Financials

Stock/Valuation

Risks

Summary

Brief history

Adobe was founded in December 1982 by John Warnock and Charles Geschke, named after Adobe Creek (Los Altos, California), which ran behind Warnock's house. Instantly became the buy target of Steve Jobs, but the founders refused. Eventually, he bought 19% stake and 5-year license fee for one of their first products called PostScript. It allowed Adobe to be the first company in the history of Silicon Valley which was profitable in its first year. In 1989 they introduced Photoshop and PDF four years later (Portable Document Format), which has become global standard format for reading documents digitally).

Since 2007 the CEO of Adobe is Shantanu Narayen, which is one of my favourite leaders. With 99% employees’ approval he won the second place in the Top CEOs 2021 on Glassdoor.

Business Model

Adobe is well diversified software company.

In the Digital Media segment (73% of the revenue, TTM YoY growth 24%) it’s a market leader in audio-visual content creation, its editing and publishing (via Creative Cloud and Document Cloud).

Their Digital Experience (24% of the revenue, TTM YoY growth 16%) segment offers solutions designed for optimizing customer experiences from analytics or workflow management to e-commerce services, all via Experience Cloud.

And there is also the smallest one Publishing and Advertising (3% of the revenue, TTM YoY drop 28%) segment, which offers products and services, such as e-learning solutions, technical document publishing, web conferencing, document and forms platform, web application development, and high-end printing, as well as publishing needs of technical and business, and original equipment manufacturers (OEMs) printing businesses.

All of those you can find below:

There is a lot of them, I know. But I also aware that your time is valuable, so I will talk only about their biggest and basically the most interesting part - Creative Cloud.

Creative Cloud

As their website stated: 90% of all creative professionals use Photoshop. But there are over hundred other apps available in the Creative Cloud, such as Lightroom or Illustrator. All of them are accesible via purchased subscription. I love subscription model, because it provides stable and predictable revenue stream over time.

It costs $52.99/month (for individuals) or $79.99/month (for teams - price per each license). Worth to mention that the teams packages price has been increased from $52.99 to $79.99 in 2018 (so over 50% increase!) and it caused absolutely no harm to the number of customers or revenues. Their price power is absolutely amazing. This is the result of the extremely strong brand that Adobe has created.

Firstly, as mentioned earlier, almost all creative professionals use Photoshop. Adobe products are industry standard and you just can’t get a job in this field without knowing Photoshop, Lightroom or Illustrator. Secondly, Adobe seeks for customers at the very early stages of life, offering some free apps for schools and students (you can find them too, don’t worry). While you are familiar with those apps and they are converging with other Adobe products, you just don’t want to switch to the others. This approach can also be viewed in terms of the potential loss of intellectual property by customer. Creators do not trust unknown products, even if they are free.

Substance 3D

While Creative Cloud apps focus on 2D creation, company revealed their own 3D tool with huge library of assets. The snag is you have to pay for it separately from Creative Cloud - $39.99/month (individuals) or $79.99/month (teams).

And this is where Augmented Reality comes into play. With Adobe Aero app you can put your work in real life. No coding needed. The application is integrated between each device or cloud environment, you can use assets from Dropbox, OneDrive or AirDrop easily.

But it’s just the beginning. What excites me the most about this whole subject is that Adobe is collaborating with NVIDIA on connecting Substance to their Omniverse, unlocking a lot of new exciting capabilities for users. The company stated that professionals at over 500 companies are currently evaluating the platform and that since the launch of its open beta in Dec‘20, Omniverse has been downloaded by over 50,000 individual creators. Actually, Omniverse is a much larger NVIDIA project (that I encourage you to read about), but anyway - creating works together in real time while being in different parts of the world? For me this is huge.

Financials

After looking at the ADBE business, let’s take a look at the financials:

Stable revenue growth - about 20% per year. Not bad, not so exciting. But now just look at the below charts. This business is extremely profitable. Even their FCF/Sales is about 40% for the last four years (shown above).

Stable Equity Ratio, about 50%, long-term debt secured, Current Assets covering Current Liabilities - balance sheet looks flawless. No further comment needed.

According to last quarter earnings: 57% of Adobe revenues is from Americas, 27% EMEA and 16% from Asia, so it is quite geographically diversified.

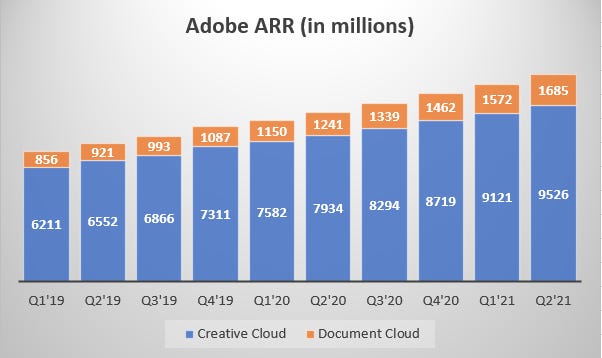

The key performance metric for their management is ARR (Annualized Recurring Revenue), which is used to assess the health and trajectory of the most important segment - Digital Media.

*ETLA - Enterprise Term License Agreement

As you can see, the recurring revenue is consistently growing quarter by quarter. That’s why I love subscription model so much.

Stock/Valuation

Valuation multiples are growing constantly for multiple years, which makes the company not so cheap choice. However, with such level of profitability and stability it is not surprising at all. It has to be paid well for that kind of quality.

The company fell less in the pandemic crash (25% vs market 34%) and returned to the ATH much faster. Since then, they doubled already (there was couple months of consolidation first) and the biggest correction was about 20% (as shown above, even crossed 200 MA for a while).

In my reasoning the price is reliable for such type of tech business (same story as ASML). Each return to the area of 200 MA will be a great opportunity to increase my position.

Risks

In fact, only one serious thing: competition.

Adobe is so diversified company that it is not so easy to find any direct competitor. Although some segments are more exposed than the others. In the most promising part of Adobe business, which is 3D (and potentially AR), the main competitor seems to be Autodesk’s Media & Entertainment Collection, with apps such as AutoCAD or Maya. Currently, Adobe is much cheaper alternative (Autodesk’s prices are growing even faster). Autodesk’s business seems slightly less stable as well, but they still has the potential to spoil the competition.

Its smaller segment, Digital Experience (cloud-based advertising, analytics, e-commerce services for enterprises) competes against other big players in the field like Salesforce, SAP or Shopify. In turn, DocuSign competes with Document Cloud. If Adobe wants to be less dependent on Creative Cloud they have to show further improvements in their offerings, because competition is tough.

Summary

Adobe is a world class software company. Their greatest powers are undeniably strong brand and unique subscription-based ecosystem. This combination makes their ability to generate cash downright enormous. Although they have many competitive advantages, they cannot rest on their laurels and constantly improve their products, because high-class competition is constantly on their heels.

I believe in their top class management. They have had a ton of great results over the past years, and I believe this trend is not going to change any time soon (especially I am excited with AR part and collaboration with NVIDIA). I proudly keep it in my portfolio and intend to keep it for years.

———————

Please let me know what do you think, any feedback will be much appreciated :)