Veeva Systems (VEEV)

Hi!

Veeva is a wonderful start-up story with visionary CEO and his view that you don’t have to burn billions to be a successful growth company. After last week Adobe review I am staying in SaaS environment. I like such business models more and more every day. Let’s check why.

This post will be a combination of data and my personal view, so please remember that this is not an investment recommendation of any kind.

I am going in the following order:

Brief history

Business Model

Financials

Stock/Valuation

Risks

Summary

Brief history

Veeva has been established in 2007 by Peter Gassner, who gained a lot of experience in IT industry, working for 18 years in IBM, PeopleSoft and Salesforce. From the beginning of his company, he was guided by the goal of sacrificing high growth for profitability, which does not seem to be a common practice among young start-up owners. He did not want to overinvest the business from the beginning, focusing on spending money wisely. The strategy seems to have paid off.

Business Model

As same as Adobe, Veeva is another subscription-based SaaS company. They are not your usual cloud provider, because they offer the platform only for Life Sciences industry, serving over 1000 customers (as the first mover practically monopolizing the market). As opposed to other CRM/Workflow providers like Salesforce, ServiceNow or UiPath (which are horizontal players trying to enter every possible area), Veeva is integrated vertically, focusing on Life Sciences sector. The company has the broadest portfolio of content and data management solutions in the market to enable pharmaceuticals and biotechnology companies to manage their businesses, going from sales, through marketing, ending with clinical research:

For sales stuff and customer info company offers Commercial Cloud CRM (built on Salesforce CRM).

For internal usage and content management you can use Veeva Vault (revenues from both segments are more or less even).

The pandemic accelerated technology adoption dramatically, especially in healthcare. And even after, no one is going to go back. Furthermore, Life Sciences is incredibly data rich, so the more companies in this sector should optimize their platforms. What is more, increasing regulations from the FDA and European Union Medical Device Regulation (EU MDR) have created a new sense of urgency for medical device companies to improve data collection and analysis throughout the total product lifecycle. Manual processes and legacy systems are no longer going to cut if companies want to ensure compliance, reduce risk, and allow for innovation moving forward. In the report from iHealthcareAnalyst you can find forecast that the healthcare cloud computing market will reach nearly $24 billion as of 2027.

Another thing: In short, when you are working in single industry like Veeva, most of your customers share similar challenges. So if you are able to solve the problem of one biotech company, the rest will probably call you soon (maybe too simplistic, but you have to admit that there is something to it). Combine this kind of economy of scale with pricing power Veeva has (because of small competition) and you can improve your margins really nicely.

But Veeva’s biggest moat is their switching cost. With the increasing regulations mentioned before, they are growing even higher. In this industry changing software provider is especially expensive and time consuming. Moreover, there is a lot of technical stuff in such platforms, so entering the market is difficult for companies which are not experienced in the field. Combine all these factors and you have the best recipe for Veeva’s success.

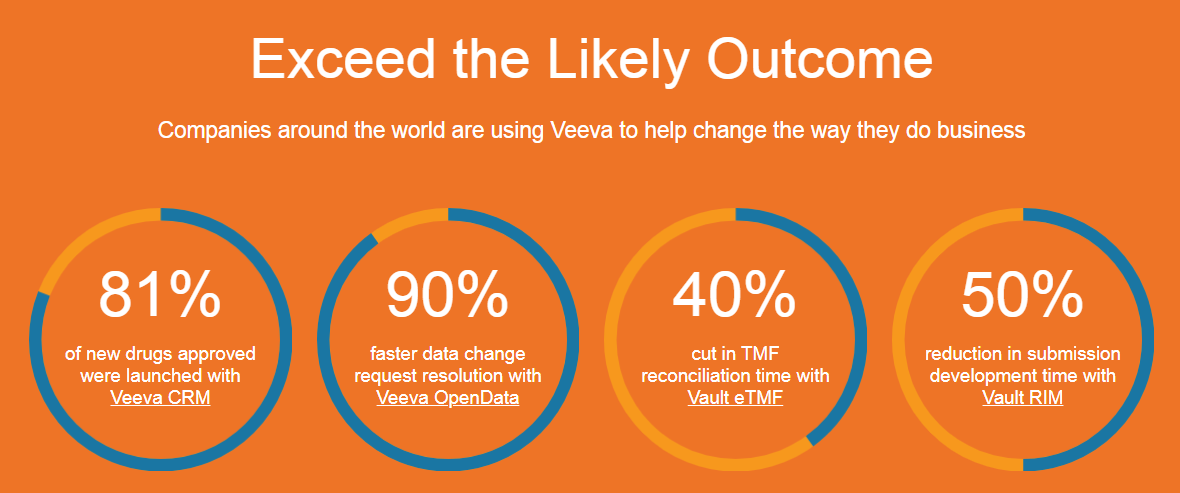

*TMF (Trial Master File) refers to a repository of documents that collectively can be used to demonstrate that a clinical trial has been conducted in compliance with Good Clinical Practice (GCP) and the approved protocol.

And their moat is constantly widening. For example, they just acquired Learnaboutgmp last month, which is a cloud-based training service provider focused on keeping life-science industry employees up to speed regarding good manufacturing practices. It's about to help train employees on how to make the most out of Veeva's service offerings, too.

Financials

After looking at the VEEV business, let’s take a look at the financials:

Predictable steady-growth revenue (about 25% CAGR), highly profitable, debt free, growing margins.

Another company in my newsletter with FCF/Sales 40%. They are so powerful compounder.

Subscription-based company like Veeva should be also reviewed through the prism of the client retention rate. In the last annual report company informed briefly that it was 122% in FY2019, 121% in FY2020 and 124% in FY2021 (ended Jan-31), which indicates they generated 24% more revenue from their existing customers last year. I like it a lot.

And the geographical breakdown of revenues is as follows:

Stock/Valuation

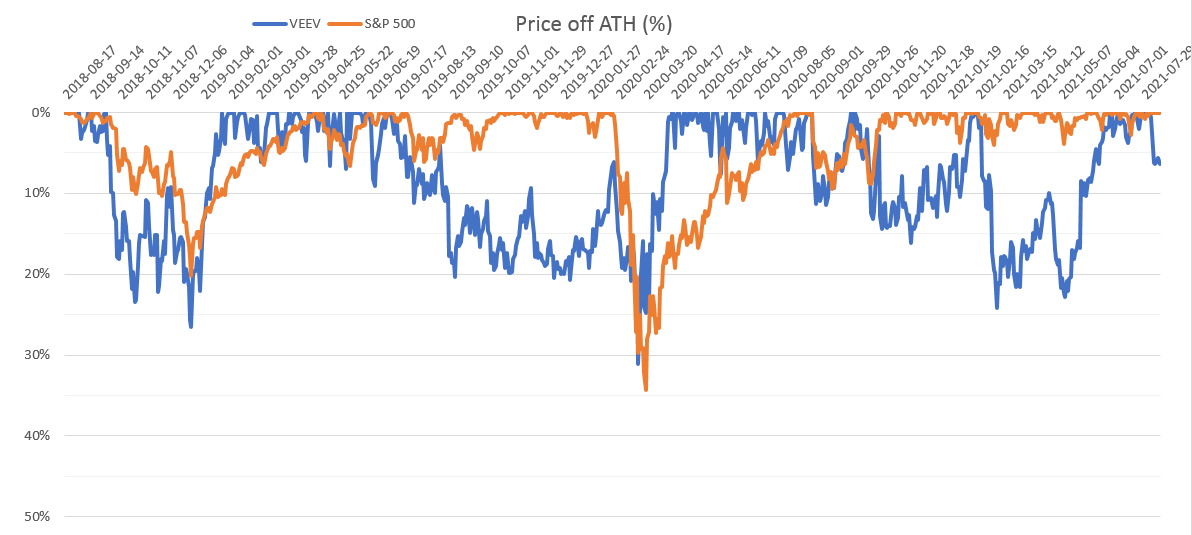

Multiples are demanding and still growing, however it is still the same story as ASML and ADBE - you have to pay for excellent quality those companies provide. Every bigger dip will be a good time to increase my position. By bigger I mean about 20%, because it is returning very quickly. Just look how fast this company returned from 30% fall to ATH after pandemic crash. Actually, the stock chart looks really similar to Adobe’s. I guess that investors are tossing all of SaaS stocks into one bag. I think they shouldn't, especially not Veeva.

Risks

In 2017 one of the company’s partners, IQVIA, sued Veeva for theft of intellectual property and this lawsuit probably will not end before 2023. The case is complex, involving the use of clients data. I am not a judge to prove who is right, but the whole case is certainly not helping the company's image.

Veeva is trying to enter new markets, such as cosmetics and packaged goods. Although for now it’s too early to say anything more, I think that any problems with the implementation may weigh on the sentiment of investors who expect further expansion of the company's offer.

You have to keep in mind that current CRM agreement between Veeva and Salesforce expires in 2025. However, they are cooperating from the beginning and I can’t see any reason for divorce. I don’t think that’s a big kind of risk.

Summary

Veeva has grown rapidly in recent years, and is very well-positioned to maintain its market leadership. They just have to keep their pace of innovation and continue to broaden its customer base. Drug companies are spending an increasing amount of money on research and development, and Veeva's products are slowly gaining adoption in new industries. As a result, I believe the company's growth story is likely just getting started and I am going to keep them in portfolio for years.

———————

If you liked it, feel free to subscribe for more:

Any feedback will be much appreciated!